Charitable Giving and Assistance Policy

At SCCU we believe it‘s important to support the Spokane community and the people who make our Inland Northwest home unique. We focus our limited resources on events, programs, projects and initiatives that benefit the broader community, where we believe they can do the most good. SCCU recognizes that community and organizational needs evolve over time, which is why we listen to our members and continually re-evaluate our program to ensure we are doing what is best for the community and the issues our members care about most.

Eligible Organizations

SCCU commits to giving one percent (1%) of their annual profits to organizations focused on the following areas:

- Spokane Library Foundation

- Children‘s Miracle Network

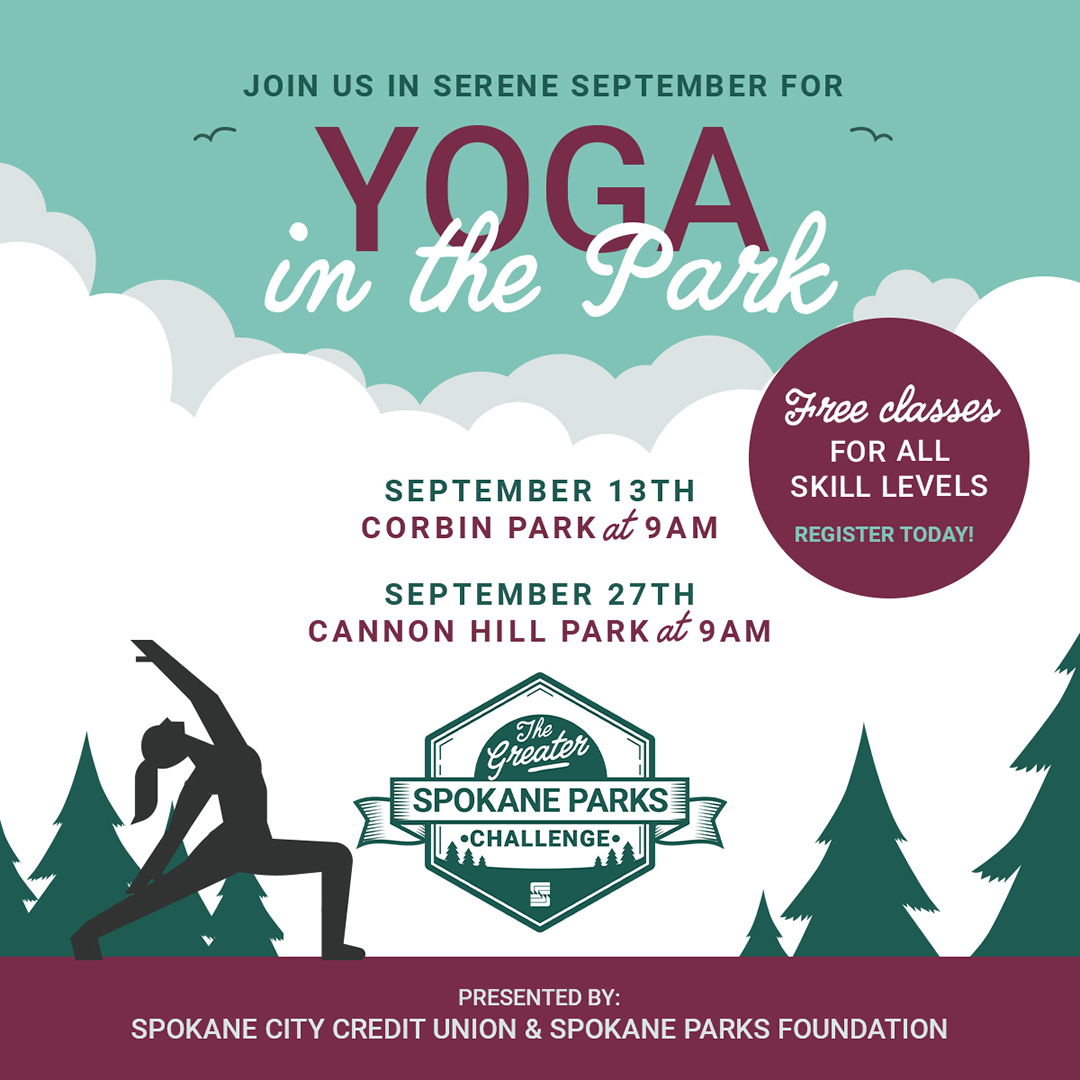

- Spokane Parks Foundation & natural resource conservation groups

Priority will be given to fund organizations dedicated to making a positive impact in these areas. In order to be eligible to receive charitable funds from SCCU, the receiving organization must:

- Be a public charity with tax-exempt status under section 501(c)(3) of the Internal Revenue Code, a Washington Nonprofit Corporation or a federally recognized tribe.

- Be registered with Washington‘s Secretary of State as a charitable organization if required. For more information on requirements for charities to register with the Secretary of State, click here.

- Under certain circumstances, applications from public entities such as school districts, municipalities or unincorporated groups or associations may be considered.

- Demonstrate an impact aligned with SCCU‘s focused giving areas.

- Benefit communities and people in Spokane County.

Ineligible Organizations

- Political or partisan organizations or affiliations

- Religious or religiously affiliated organizations

- Organizations that discriminate on the basis of race, ethnicity, creed, gender, sexual orientation, religion, disability, familial status or any other protected class.

- Individuals

Requesting a Donation from SCCU

All requests for donations should be submitted in writing and include the following:

- A letter of request on the organization‘s letterhead

- A brief description of the organization including mission and programs.

- The specific purpose for which the funds are being requested. Include a description of the population being served.

- The dollar amount being requested, up to $500

- A list of the organization‘s current leadership including board members

- A copy of the organization‘s tax-exempt status or nonprofit designation as a government or tribal entity, as well as the Tax Identification Number (TIN)

- A completed W-9 IRS form.

Please send requests to:

Spokane City Credit Union

Attn: Charitable Giving

1930 N. Monroe St.

Spokane, WA 99205

Requests for Publicity

When members of SCCU or the public request assistance with publicity of an event (such as a posting information about fund raiser for an individual with an illness) the request must meet one of the following criteria:

- Member in good standing at SCCU.

- Individual who work with vendors who have a business relationship with SCCU.

- SCCU is a registered member of the group such as the N. Monroe Business District.

- All requests for publicity must be for a specific time period and or event.

- The event must be open to all individuals, non political and not affiliated with any church or religious group.