What is SCCU CardNav?

Technology that enables superior control, security, and financial visibility via your mobile phone. It lets you manage your cards on-the-go.

You control when and where your cards can be used, as well as view and act on instant alerts when transactions are processed.

What are the benefits?

- Control where, when and how your cards are used

- Turn cards on and off instantly from your mobile device

- Limit spending amounts to reach budget goals

- Restrict types of purchases made

What types of controls and alerts can I set/receive?

The following controls and alerts can be customized individually by card:

| Type | Control Preferences | Alert Preferences |

|---|---|---|

| Location Based on where the transaction occurs (merchant location). | Set geographic restrictions where the card can/can’t be used.

Note: You will still need to notify us if you are traveling, as all host settings override any CardNav setting. | You can set up one of the following location policies. Only one location can be set at one time, and the location policy is always based on the primary device.

|

| Spending Limits Based on the threshold amount set by the user. | Restrict transaction based on the dollar amount:

Set thresholds for available balance:

| Any of the following alert threshold preferences may be set:

|

Transaction Type Based on type of transaction at point of sale. | Any of the following types may be turned

on to deny transactions of that type:

| Any of the following types may be turned on

to send an alert when a transaction of that

type occurs:

|

Merchant Type Based on the type Note: These are ignored for ATM and Auto Pay transactions. | Any of the following types may be turned on to deny transactions of that type:

| Any of the following types may be turned on to initiate an alert when a transaction of that type occurs:

|

On/Off | Only allow transactions when you turn your card on:

| N/A |

Can SCCU CardNav be controlled from a desktop or laptop computer?

No, SCCU CardNav can be controlled and viewed by either a smartphone or iPad

Whom do I contact to get started or for support?

Please contact us directly with any support questions.

Will SCCU CardNav work outside the U.S.?

Yes. If your phone has an internet connection, SCCU CardNav will work.

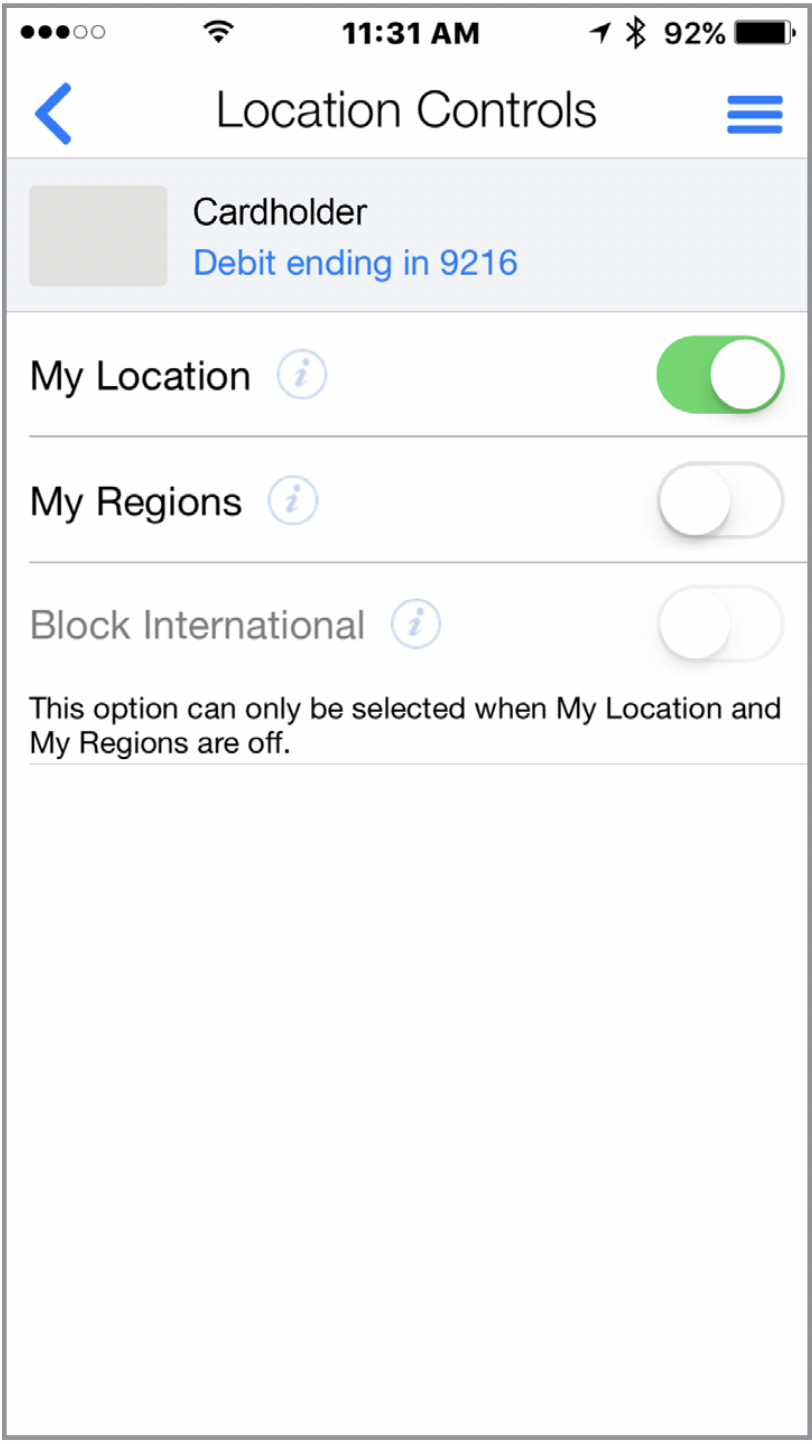

Does location functionality depend on phone signal?

An alert is triggered or a control is initiated by in-store transactions that occur outside of the area where your primary mobile device is located. The mobile device must have location services (GPS) enabled with permission to use the current location. If your phone is turned off, without cellular service, or does not provide GPS location coordinates it will use the last saved GPS location. However, if this situation occurs for more than eight hours, SCCU CardNav temporarily ignores the My Location policies. Transactions would not trigger alerts or control denials based on My Location preferences during this time; however an alert would be generated informing you that a transaction was conducted.

How long can I leave a card “off”?

You can turn your cards off, leave them off as long as you want to, and only turn them back on when you want to perform transactions.

How many cards can each user set up?

There is no limit to the number of cards that you can set up, as long as the account is with a credit union offering the same controls and alerts offering at each location.

If I have two credit union accounts and a debit card with each, can I manage the different cards from the same SCCU CardNav account?

A separate account would be required for each card that belongs to different credit unions.

Are notifications via push, or do you have to be logged in?

Notifications are push notifications in app. You do not need to be logged in.

Does the service time out (log off) after a period of time?

Yes, for security purposes this does occur.

What if I have my card turned off and a recurring utility bill wants to charge my card? Will that transaction be denied?

When the card is off, most card transactions are denied by the service and alerts are generated for attempted transactions. However, Auto-pay transactions and credits (deposits, returns and reversals) are exempt from this high-level control.

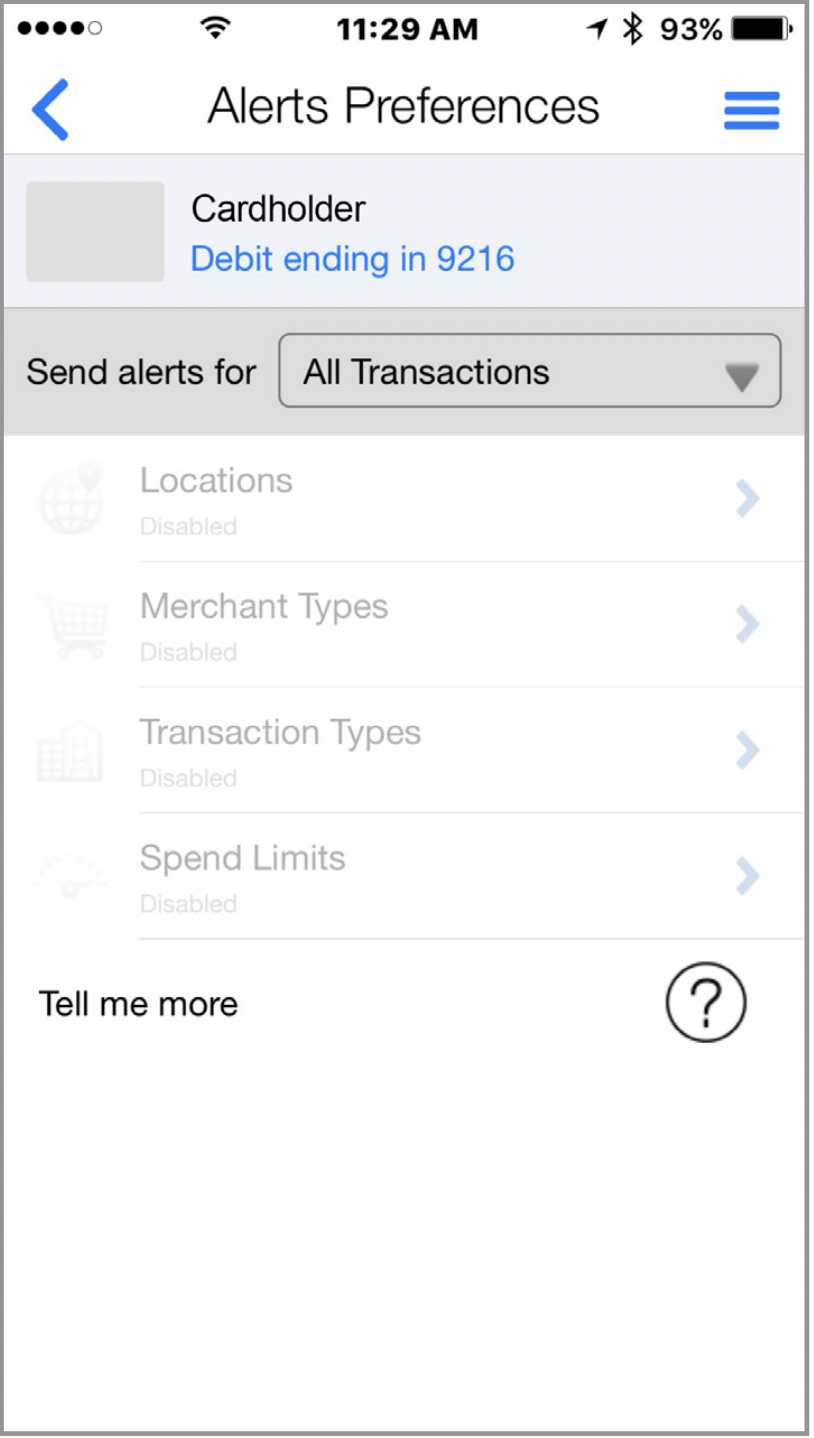

Take a tour and get acquainted with the Alert Preferences first. Review the alert options and decide if you would like to receive alerts on all transactions or specific purchases.

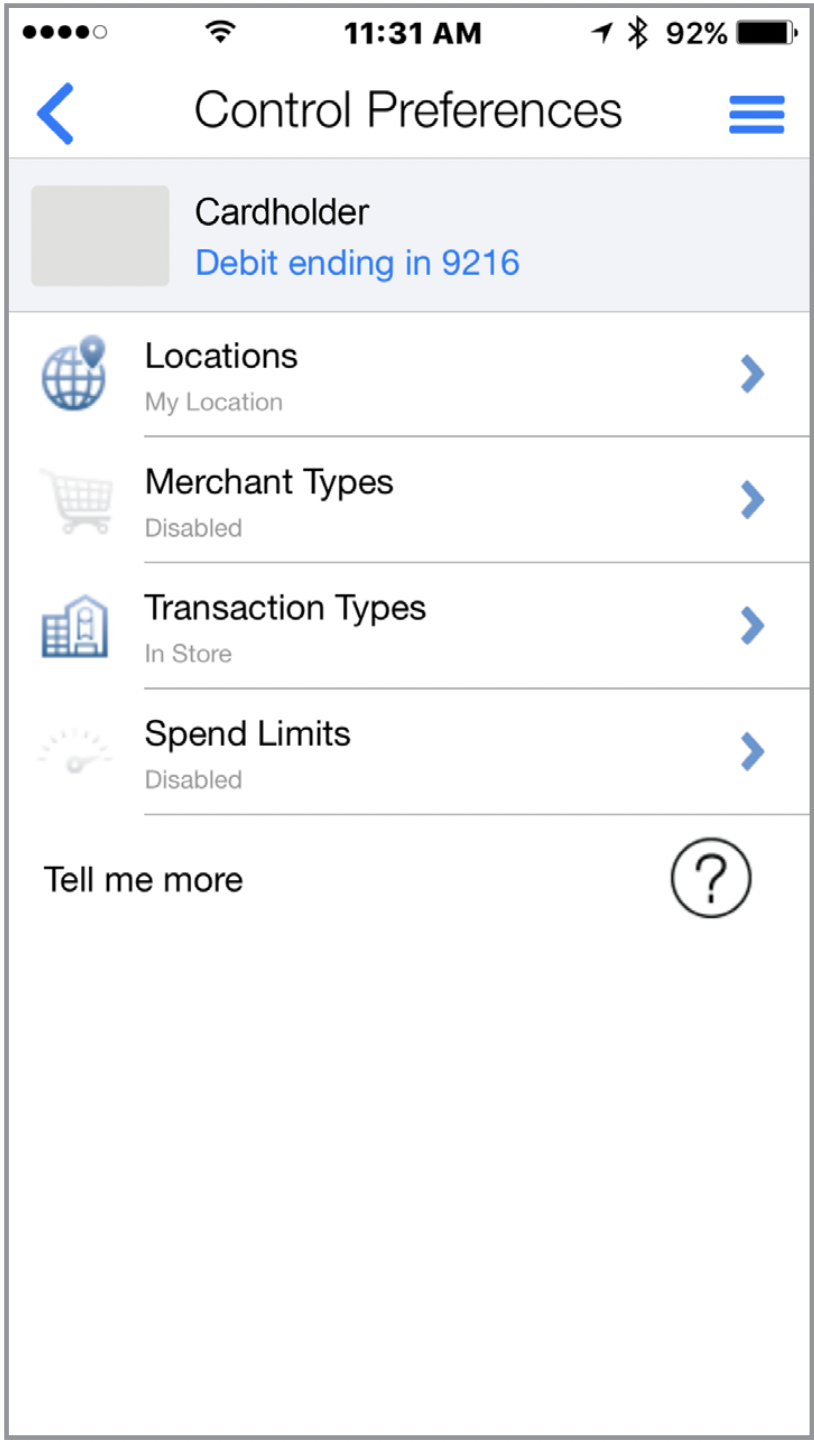

Then enable Control Preferences to set spending limits and configure policies for when and where your card can be used.

Set Location Controls to deny transactions outside of a specified region or away from your mobile device.

This is the best way to learn about all the settings you can use to stay on budget, keep you safe while traveling, or just monitor your account for fraudulent activity.

The Help tab has everything written out in plain text if you would like to read more in depth